We are all taught the same fundamental truth of investing: Stocks go up over time.

We are shown a chart of the S&P 500 moving from bottom-left to top-right and told, “Just buy, hold, and wait.” For the index, this is true. But for individual stocks, this is often a dangerous lie.

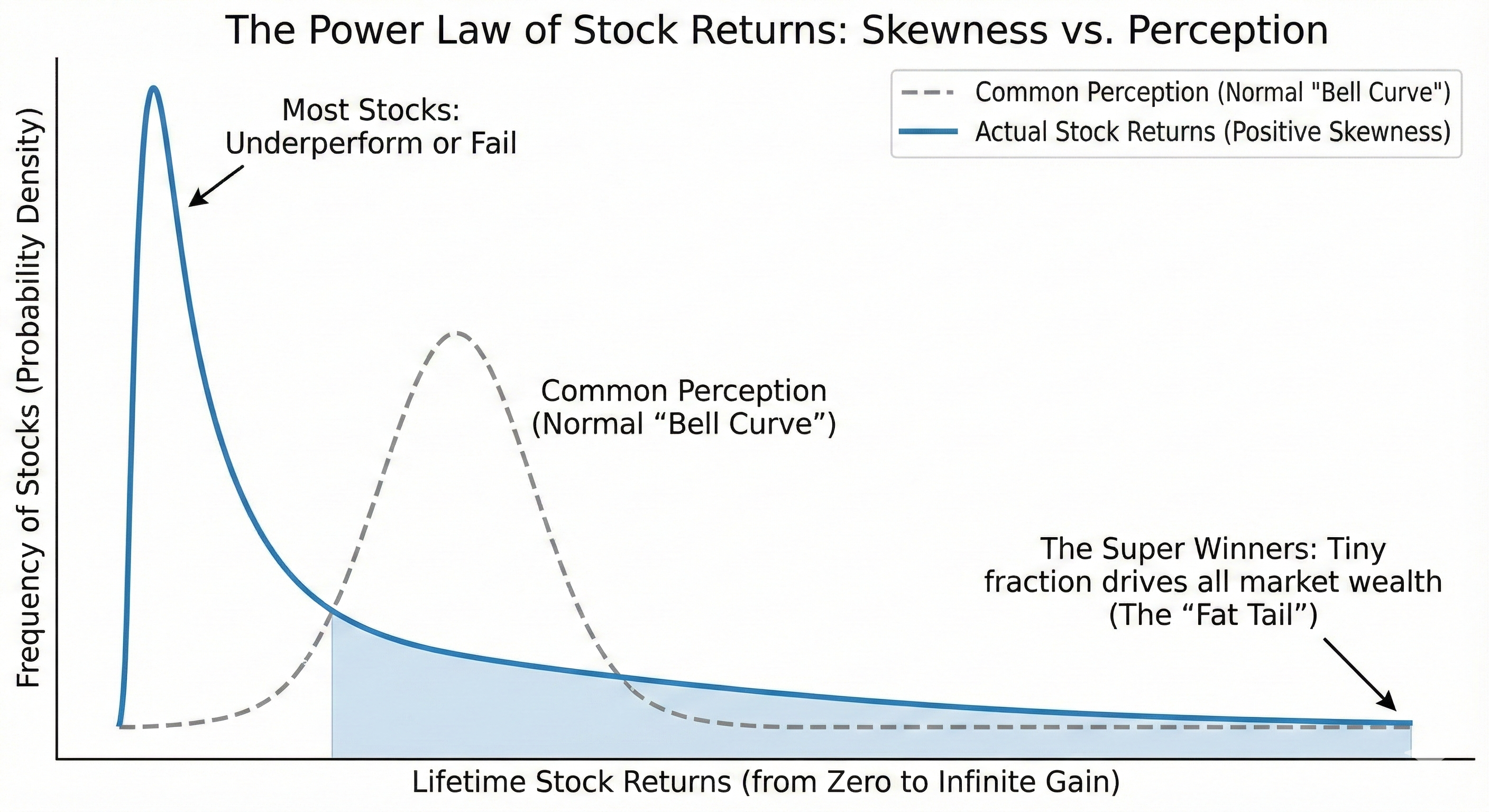

The reality of the stock market is governed by a ruthless mathematical force called Positive Skewness.

Most stocks are not “average.” In fact, the majority of individual stocks will underperform a Treasury Bill over their lifetime. A shocking number will go to zero. The market’s overall returns are driven by a tiny handful of “Super Winners” that disguise the mediocrity of the rest.

I recently upgraded my investing mental model to account for this reality. Here is what I learned about Skewness, the “Volatility Tax,” and how to survive the math of the market.

The Villain: Skewness and the Power Law

Standard finance assumes stock returns fall on a normal “Bell Curve”—most are average, with a few winners and a few losers. The reality, as proven by Professor Hendrik Bessembinder, looks very different.

It is not a bell curve; it is a Power Law distribution.

As the graph above illustrates:

-

The Left Peak (The Majority): Most stocks deliver poor or negative returns. They are the “96%” of companies that barely break even or eventually fail.

-

The Right Tail (The Super Winners): A tiny fraction (about 4%) of stocks generate virtually all the net wealth in the stock market. They pull the “average” up, hiding the fact that the “median” stock is a loser.

The “Buy & Hold” Trap (and the Index Exception)

If you buy a single volatile growth stock and hold it forever, the odds are statistically against you. Unless you are lucky enough to hold one of the rare “4%” in that thin right tail forever, the natural gravity of Skewness suggests your stock will eventually stall or crash.

However, there is one major exception: The Market Index (S&P 500).

The Index is immune to this trap because it is not a static asset; it is a self-cleansing, adaptive system. It operates on a ruthless “survival of the fittest” algorithm.

-

It cuts the losers: When a company fails or shrinks (falling into the 96%), it is automatically removed from the index.

-

It adds the winners: When a new superstar emerges, it is added to the index and its weight grows as its market cap rises.

By holding the Index, you are effectively outsourcing the “survival” problem to the system. The Index guarantees you will own the 4% of super-winners because its rules force them to the top, while the losers are quietly flushed away. Individual stocks offer no such protection.

Two Ways to Tame the Power Law

Understanding this distinction reveals why the “rules” of investing seem to contradict each other. Why does the Index get to “let winners run” while you, the stock picker, must “trim winners”?

It is because they are two fundamentally different systems for managing the same force (Skewness).

System 1: The Index (The Momentum Machine) The S&P 500 manages skewness through Survivorship.

-

The Rule: It operates on momentum. When a company wins, it becomes a larger part of the portfolio. When it loses, it is ruthlessly cut.

-

Why it works: The Index owns 500 companies. It has “infinite” diversification. If its top stock (say, Apple) crashes, the Index takes a bruise but survives. Therefore, it can afford to ride the “Right Tail” of the Power Law all the way up without selling.

-

The Mechanism: Survival of the Fittest.

System 2: Your Portfolio (The Harvesting Machine) Your individual stock portfolio manages skewness through Volatility Harvesting.

-

The Rule: It operates on mean reversion (Bessembinder’s Rebalancing). When a company wins, you trim it. When it lags, you buy it.

-

Why it works: You only own 10-20 stocks. You have “finite” diversification. If your top stock crashes, your portfolio is destroyed. Therefore, you cannot afford to ride the “Right Tail” forever. You must bank the winnings to ensure survival.

-

The Mechanism: Insurance and Risk Control.

The Takeaway: Don’t confuse the systems.

-

If you own the Index, be lazy. Let the system clean itself.

-

If you own Individual Stocks, be active. You are the system. You must harvest the volatility because, unlike the Index, you don’t have 499 other companies to save you if your favorite stock dies.

The Mechanism: The “Volatility Tax”

Why does holding a volatile stock hurt your returns? It’s due to a hidden cost called Volatility Drag (or the Variance Drain).

Volatility eats compounding.

-

If a stock falls 50%, it requires a 100% gain just to get back to even.

-

If a stock is highly volatile (wild swings up and down), your compound return (what you actually keep) will always be lower than the average return (what the screen shows).

This gap is the “Volatility Tax.” The more a stock swings, the more tax you pay to the math gods.

The Solution: Rebalancing (Volatility Harvesting)

While “Buy and Hold” works for the Index (which naturally refreshes itself with winners), Rebalancing is the superior strategy for individual volatile portfolios.

Rebalancing is simply Volatility Harvesting.

-

The Harvest: When a stock surges (a “Right Tail” event), you sell a portion of it.

-

The Logic: You are acknowledging that trees don’t grow to the sky. You are converting “paper wealth” (which is fragile and subject to volatility drag) into “real wealth” (cash).

-

The Reinvestment: You move that capital into undervalued assets or stable compounding.

By systematically trimming the winners, you prevent a single stock from becoming “too big to fail” in your portfolio. You stop the “maths of the market” from working against you.

The Psychology: Taxes as an “Insurance Premium”

The biggest barrier to this strategy is the fear of taxes. “I don’t want to sell and pay 20% to the government,” we say.

This is a mistake. You need to reframe the Capital Gains Tax not as a penalty, but as an Insurance Premium.

-

Buying a Put Option: When you sell a stock that has doubled and pay the tax, you have effectively bought an insurance policy against a future crash. You paid a known cost (the tax) to eliminate an unknown catastrophic risk (the stock going to zero).

-

Buying a Call Option: The cash you generate is a “Call Option” with no expiration date. It gives you the freedom to buy any asset in the future when prices are lower.

Don’t let the tax tail wag the investment dog. Paying the premium is often the only way to lock in the win.

The Playbook: Duration and Volatility

This model doesn’t apply to everything. You must treat stocks differently based on their nature.

1. The “Power Law” Candidates (High Volatility / Growth)

-

Examples: Palantir, Tesla, Crypto.

-

Strategy: Aggressive Rebalancing.

-

Why: These assets have extreme skewness. They are lottery tickets. When they hit the right tail, you must harvest the volatility. If you “let them run” forever, the volatility drag and mean reversion will likely wipe out your gains.

2. The “Bell Curve” Candidates (Low Volatility / Quality)

-

Examples: Coca-Cola, Johnson & Johnson, Berkshire Hathaway.

-

Strategy: Buy & Hold.

-

Why: These stocks are stable compounders. They don’t have the massive skewness that requires harvesting. Paying taxes to rebalance them is usually a waste of money. Let them work.

3. The Giants (Mega-Caps)

-

Examples: Apple, Microsoft.

-

Strategy: Capping.

-

Why: Use a simple rule (e.g., “Max 15% position size”). Only trim when they threaten your survival by becoming too concentrated.

The Buffett Nuance: Survival above All

You might ask, “Where does Warren Buffett fit in? Doesn’t he say his holding period is forever?”

Buffett is often misunderstood. While he prefers to let winners run, he is actually the ultimate practitioner of Risk Management. He does not trim because a stock went up; he trims when the “Risk of Ruin” rises.

-

Sector Risk: He dumped his beloved Bank stocks when he saw systemic danger.

-

Concentration/Valuation: He trimmed Apple when it became a massive chunk of his portfolio at a high valuation.

He is not a “Buy and Hold” zealot; he is a Survivor. He knows that because he runs a concentrated portfolio (System 2), he cannot afford a single fatal error. If the Oracle of Omaha sells winners to manage risk, you should not feel guilty for doing the same.

Conclusion: Choose Your System (or Use Both)

Investing is not just about picking winners; it’s about surviving the math, and, more fundamentally,

-

Skewness means most stocks will fail you.

-

Volatility means the journey will erode your wealth.

-

Rebalancing is how you defeat them both.

Investing is also about choosing which mathematical system you want to employ.

-

System 1 (The Index): Rely on the market’s natural “survival of the fittest” mechanism.

-

System 2 (The Active Picker): Build your own system of harvesting volatility and managing skewness. Stop hoping for average returns in a Power Law world. Harvest the volatility, pay the insurance premium, and compound your way to safety.

If reading this post made you feel tired or anxious—if the idea of tracking volatility, calculating position caps, and harvesting variance sounds like a second job—then I have good news.

You can just buy System 1.

By buying an Index Fund (like the S&P 500), you are hiring the ultimate “momentum manager” to do this work for you. You will get the winners, you will survive the losers, and you will never have to pay a volatility tax again.

But if you choose to pick stocks, do not be a gambler. Be a system. Harvest the volatility, pay the insurance premium, and survive the math.